Now that the vaccination programme is underway, what impact will this have on the UK economy and on business? How close is recovery and when can we expect things to return to ‘normal’? To review what the landscape will look like as we move beyond the pandemic we interviewed economist and university lecturer, Professor Trevor Williams.

UK economic outlook depends on the vaccine

The coronavirus and Brexit will determine UK economic performance this year. Despite the discovery of a vaccine, the effects of the pandemic are not over; the year has started with a lockdown of the economy and the worst death rates since March 2020. That means growth in the first quarter of 2021 is likely to be negative, albeit by 'only' 2%, − similar to the fall in the last quarter of 2020. We are therefore likely to have two quarters of negative growth − the definition of a recession. Brexit is contributing to this by making it more difficult to trade with Europe.

However, the UK economy will still grow this year compared to 2020, if only because the fall last year was so large, it is unlikely to be repeated. A few months ago, consensus forecasts showed growth of around 6% for the year, but 5% is now expected.

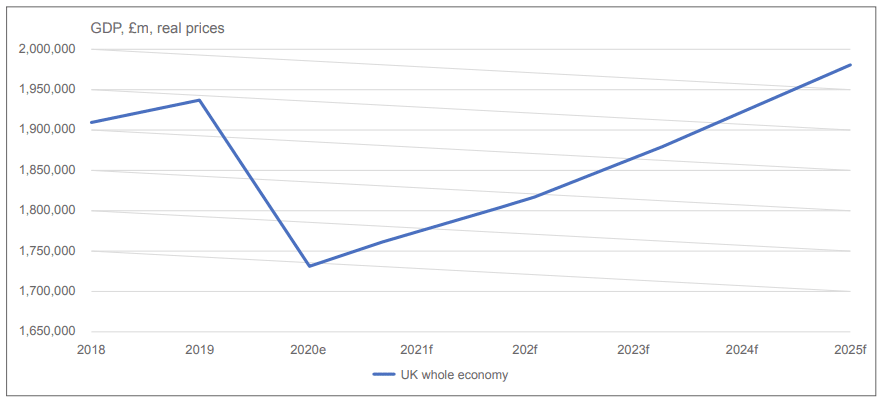

Over the next five years, our forecast shows UK growth averaging 2.8% per annum. However, it will take three years or more to regain its pre-pandemic peak in output, as we can see from chart A.

Chart A: UK GDP will not regain its 2019 level until 2024

Source: TWC forecasts /ONS

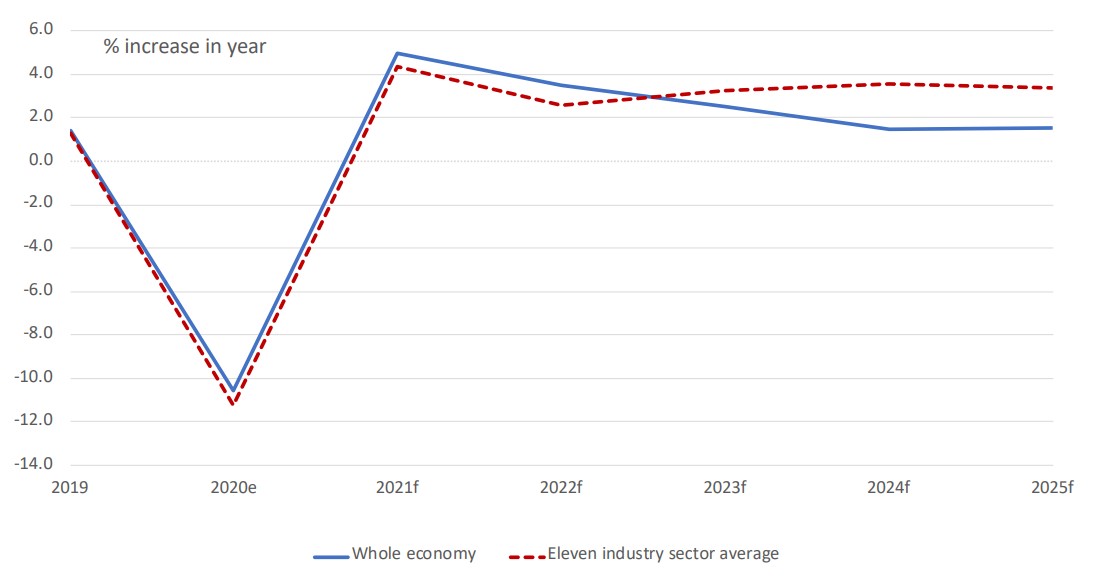

But it is also essential to understand which sectors will outperform and underperform this average. Disaggregating the UK's macro performance to industry level shows that aggregate average growth in 11* specific sectors will exceed that of the whole economy over the next five years – 3.5% compared with 2.8%, as shown on Chart B. A strong rebound in aviation and the hospitality & leisure sectors stands out, as does robust expansion in healthcare and professional services. Oil & gas and agribusiness are likely to underperform.

Vaccination is key to recovery prospects

Economic performance in 2021 will depend on the successful rollout of the vaccine. For 'normality' to return, vaccinating about 60 to 70% of the population would be ideal. So, 47million people will have to be vaccinated, preferably in the first half of this year, for the economy to open fully in the second half.

If 2m people are vaccinated each week − the government's target − then it will take nearly 24 weeks for 47m to be vaccinated, which brings us to June. Assuming second doses are administered in this time, it means 94m doses would have to be delivered in six months. By any measure, that's a big logistical ask of the NHS.

Chart B: Disaggregated forecasts show 11 industries outperform the UK average>

Source: TWC forecasts / ONS

Brexit will have an impact, but mainly over the longer term

Our five-year forecasts include an EU free-trade agreement for goods (there is no deal for services). The Office for Budget Responsibility estimates that leaving the EU's customs union and single market reduces UK output by 4% in the long term. Therefore, Brexit – a deal in goods (10% of the economy) but not services (80% of the economy) − lowers the UK's long-term growth potential. It adds 'friction' to trade, so reduces economies of scale and productivity by restricting the UK's access to markets and skills.

Due to the ongoing pandemic, this year does not augur well for employment, business or the state of public-sector finances. There will undoubtedly be further increases in unemployment, which we expect to peak at over 7% in 2022, with a cascade of business failures coming behind it. Most of the pain (redundancies and bankruptcies) will fall on hospitality, leisure, retail and customer-facing services. But its full impact will only become apparent when furlough and other government support schemes end or taper.

Fiscal and monetary policy to remain loose to support recovery>

The current lockdown means that public-sector debt levels are likely to be higher than expected for longer. But fiscal tightening in 2021 is unlikely, given the risk of undermining the recovery. Indeed, the Chancellor has already announced £9bn of further spending. He also extended the furlough, and other schemes, to the end of April. Additional extensions are likely if recovery stalls.

A slow recovery will add to government borrowing, bringing it over £400bn for the current fiscal year − the highest-ever level in peacetime. Outstanding debt is likely to be around 107% of GDP in the current financial year, compared with the 85% of GDP recorded in 2018/19.

Despite this, significant cuts in public spending or tax rises are highly unlikely until 2022 at the earliest. When they do occur, tax increases are likely to be linked to the faster-growing sectors or where income growth justifies some increase in personal taxation. We can safely rule out a return to the austerity seen a decade ago.

But with low price inflation and little wage pressure, interest rates will remain extraordinarily low for longer. They could even be cut further if economic conditions worsen. Expect a 0.1% bank rate and quantitative easing of around £1 trillion to persist over the next three years at least.

A robust economic bounce back will occur this year

With supportive monetary and fiscal policy and recovery in the rest of the world, there will be a significant bounce back in the UK economy this year, of 5%. An increase in world output will also boost the UK, where the value of exports and imports comes to around 64% of GDP − one of the world's highest ratios.

The world economy should expand by 5%, led by emerging economies. Growth in China, meanwhile, is likely to be up to 8%. Recovery in the US is likely to be on par. The European economy is expected to be 4-6% larger than a year ago.

UK households are likely to run down their current high level of savings over the years ahead, leading to faster growth in consumption. Even business investment, likely to fall this year, should recover next year. Public investment is forecast to remain robust, driven by the 'levelling up’ agenda and the need for fiscal stimulus.

But ‘levelling up’ will require more than just increased infrastructure spending. It will also require significant decentralisation of power from central government to local government, giving them more control over spending and budgets. A focus on educational and technical skills and promoting infrastructure interconnectedness will help lift productivity, but it won't be cheap. Harnessing all of these ingredients will be crucial to success, but a quick fix seems unlikely.

*The 11 sectors selected are aviation, agribusiness, fintech, healthcare, hospitality & leisure, oil & gas, professional services, real estate, retail and transport & logistics and not-for-profit.

Professor Trevor Williams is the former Chief Economist at Lloyds Bank Commercial Banking, a visiting Professor at the University of Derby, rotating Chairman of the Institute of Economic Affairs Shadow Monetary Policy Committee (SMPC) and author of Trading Economics: A Guide to Economic Statistics for Practitioners (with Victoria Turton). Trevor also lectures at CASS business school and Cardiff University and regularly writes articles for publications including Moneyfacts, Clear Path Analysis, and Economia as well as the financial press.