What makes us different

- A single team: our team is a blend of complimentary, multi-disciplinary technical experts with broad commercial real estate experience. We provide a seamless service delivering all the expertise you need in one place.

- Hands on experience: our real estate specialists from our joint venture partner, Cap Real Estate, have worked in a professional advisory capacity, as property lenders and as the principals of property investment and development companies. We speak your language.

Who we are

Our team combines the professional expertise of three complimentary disciplines to provide a seamless service covering all components of any distressed real estate restructuring and recovery project.

|

|

|

| Our real estate specialists from Cap Real Estate, our joint venture partner, have variously worked in a professional advisory capacity, as property lenders and as the principals of property investment and development companies. | Our insolvency and restructuring professionals are experts in crisis management and the execution of rescue strategies. When necessary, they will take control of distressed entities or assets. | Our tax specialists advise on financial structuring, international tax and complex transactions covering all direct and indirect tax aspects of a distressed real estate project. |

What we do

We use a clear methodology to deliver enhanced outcomes when dealing with a distressed real estate project. We provide advice on-site origination, acquisition support, planning, building design optimisation, development funding, the enforcement of lender security and exit planning.

- We provide independent reviews to evaluate the current situation and examine all restructuring options, including both formal and informal (non-insolvency) options.

- We focus on managing risk, controlling costs and maximising exit values within a timeframe appropriate to the circumstances.

- We manage and deliver the plan, implementing the solution in a controlled manner.

- We like to work consensually alongside owners, borrowers and other influential stakeholders, but are also comfortable dealing with non-consensual enforcement scenarios.

Our insolvency practitioners are licenced in the UK to act as:

- Administrators

- Fixed Charge Receivers

- CVA Nominees and Supervisors, and

- Qualified to advise on Part26a restructuring plans and Schemes of Arrangements

Advising across the value spectrum

We advise on a broad range of real estate restructuring matters, large and small, complex, and simple, from single asset enforcement projects to complex planning, development, and build-out projects.

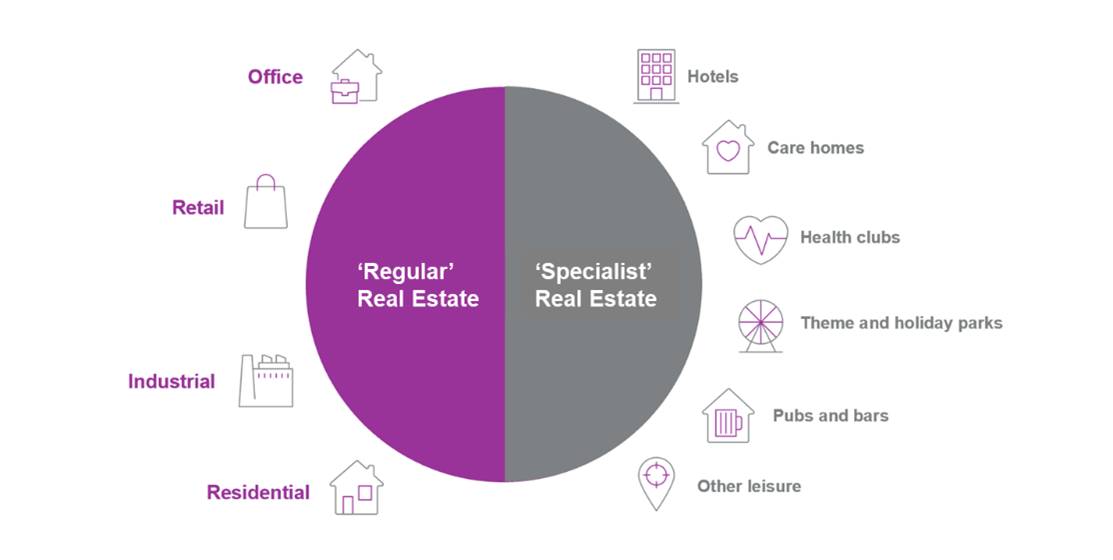

Complete asset coverage

Our team provides advice regarding ‘regular' real estate investments and 'specialist' real estate assets involving integrated operational business.

Our costs

Our approach

- We always seek to align our goals and outcomes with those of our clients. We regularly agree capped, contingent and incentivised fee structures.

- We remain flexible on fee structures and map our fees to the circumstances and context of our engagement.

- We are nimbler and, therefore, more cost effective than many of our larger competitors.

- We use a refined and proven methodology to maximise cost-efficiency.

- We use the right insolvency process and project team to minimise overall net cost.

International coverage

With offices in key offshore locations around the world, we advise on complex cross-border scenarios and cases where assets may be held in several jurisdictions. Today, we have teams in Cyprus, Mauritius, the Cayman Islands and the UEA that work collaboratively on complex cross-border asset recovery, restructuring, insolvency and forensic accounting assignments.

Fractional ownership in real estate: watch on-demand

Watch our webinar where a panel of experts share their insight and experiences of solving complex problems arising in fractional ownership arrangements for real estate assets.